AML Advisory & Audits

Anti-Money Laundering Compliance

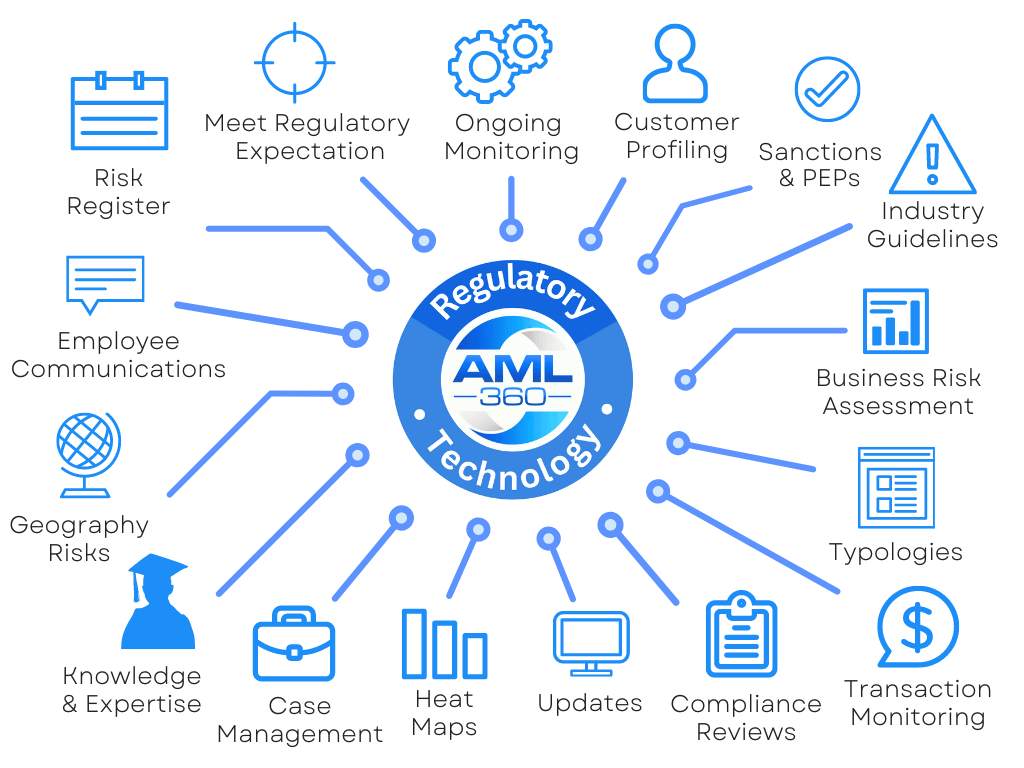

We deliver more than advisory and auditing services. For 10+ years we have been keeping businesses compliant with AML/CFT regulatory technology. We simplify compliance with digital forms and automate AML/CFT compliance complexities. Your business gains compliance efficiency and reduces operational business costs.

If your firm has not yet experienced the benefits of regulatory technology, get in touch with AML360 for a free trial.

The obligations of anti-money laundering compliance require a business to have an in-house or external AML/CFT compliance professional. AML360 technology wraps an AML/CFT compliance professional into a digital solution.

Automated Work Flows

Technology for Anti-Money Laundering Compliance

Anti-money laundering compliance involves collecting data, formatting reports, conducting risk profiling, management reporting and record keeping.

There are also technical issues requiring subject matter expertise in (a) money laundering, (b) terrorism financing, (c) sanctions, (d) fraud, (e) financial crime, (f) risk profiling, (g) interpretation of risk-based laws and (g) knowledge in qualitative and quantitative risk management methodologies.

AML360 provides an end-to-end platform enabling AML Compliance Officers to ‘point and click’ for an all-in-one solution that operates with all the necessary components to ensure regulatory effectiveness is achieved.

Low Cost Plus Efficiency

Managing AML Compliance in the Cloud

AML360 has eliminated complexities in managing anti-money laundering compliance. The software is configured to provide your firm with ongoing maintenance of a business risk assessment, know your customer, risk profiling, activity monitoring, training, compliance reporting, case management, geography risks and more.

Automated Work Flows

Governance & Compliance Reporting

Regulatory expectation is increasing from AML/CFT Supervisors. From June 2024, these increased expectations become a regulatory requirement. Business owners, senior managers, directors of Boards and risk managers are obligated to be informed of AML/CFT compliance risks and provide evidence-based policies, procedures and controls that effectively manages those risks. AML360 has been protecting businesses for 10+ years by using a qualified risk-based approach. Protect your business with technology that objectively achieves AML/CFT regulatory expectation.